HMRC launches new personal tax accounts

| Posted by: lauren | No Comments

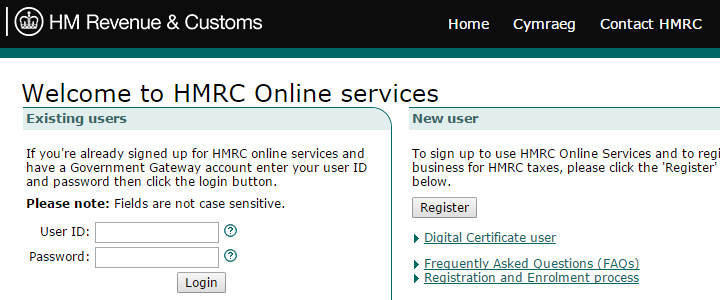

HM Revenue and Customs (HMRC) will shortly be launching their new system of personal tax accounts, which is set to replace the current annual tax return.

The online accounts will allow people to see their tax details and make payments at anytime, and will be similar to that of online banking.

All personal tax payers will have their own accounts by April of next year, as will all of the countries 5 million small businesses. The system will phased in for those individuals who have a Unique Tax reference (UTR) under the self assessment system, and nearly 2 million businesses already have access to the new system.

HMRC aim to have all tax payers, whether individual or corporate, under the new system by 2020.

From April 2018, businesses including the self employed and landlords, will have to update HMRC every quarter where this activity is their main source of income. The obligation to report quarterly will also apply where the money received is a secondary source of income worth more than £10,000, and the main income is from employment or from a pension.

Long term, HMRC plans to bring all the information it holds on a taxpayer into one system, including data from employers, banks, building societies and other government departments. This will over time lead to the dissolution of the annual tax return and current self-assessment system, introduced back in 1996.

For further information call now on 0800 8654330 or email lauren@helloaccountancy.co.uk

Leave a Comment